The pros and cons of turning your home into a rental

If you’re buying a new home, you may have thought about keeping your current home and renting it out. In March, average rents for one- and...

1 min read

Scott Henvey

:

Jul 17, 2023 9:56:30 AM

Scott Henvey

:

Jul 17, 2023 9:56:30 AM

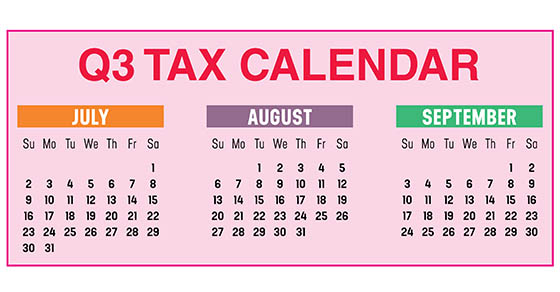

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

July 31

August 10

September 15

© 2023

If you’re buying a new home, you may have thought about keeping your current home and renting it out. In March, average rents for one- and...

If your business doesn’t already have a retirement plan, it might be a good time to take the plunge. Current retirement plan rules allow for...

If you operate a business, or you’re starting a new one, you know records of income and expenses need to be kept. Specifically, you should carefully...