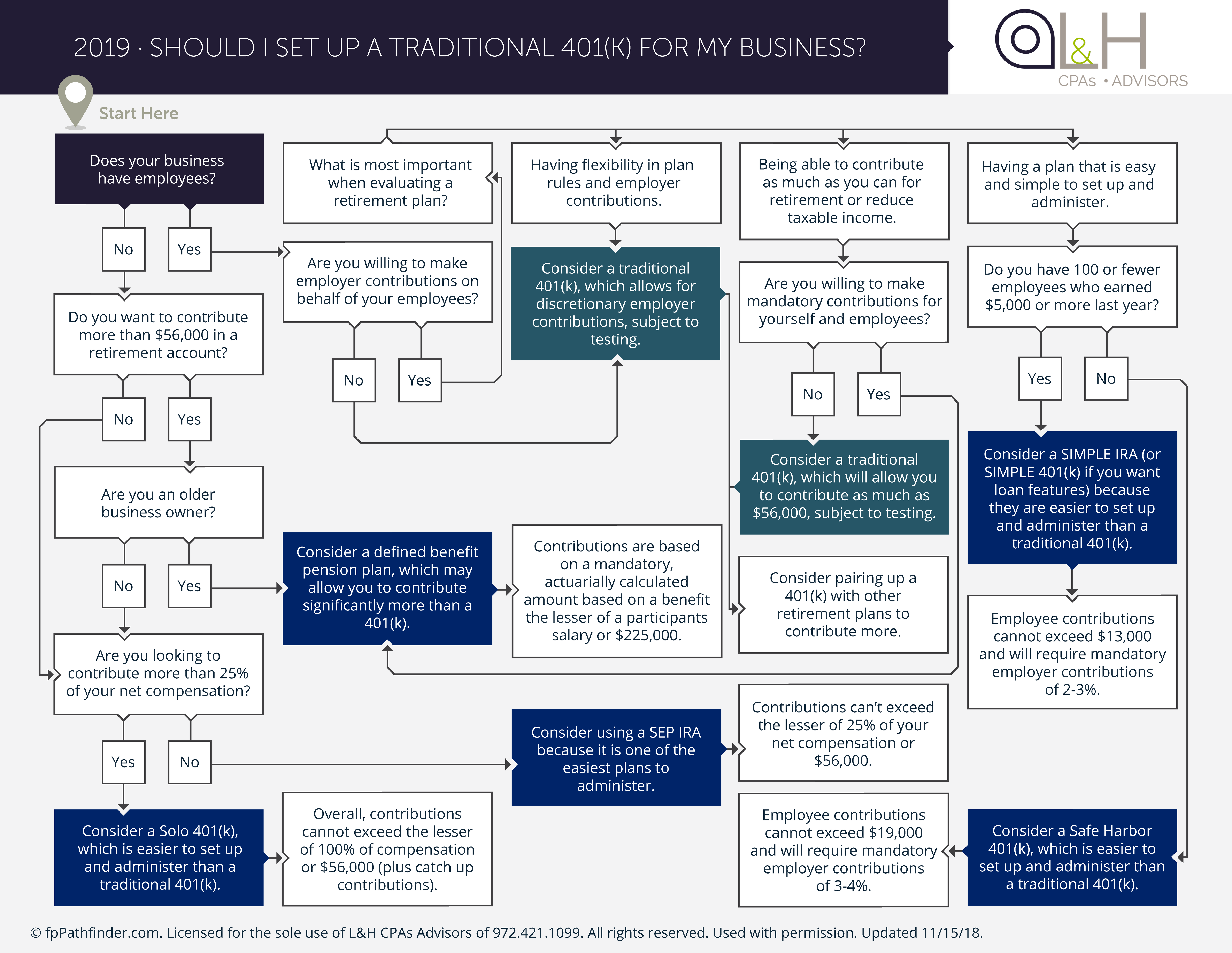

Business owners who are considering a retirement plan for their business have many options. While a traditional 401(k) is a well-known option, there are many cases where other retirement plan options are worth considering.

To help you make better financial decisions, we have created this flowchart. It addresses some of the most common issues that arise when choosing a retirement plan for you business:

- Which plans may be better when there are no employ

ees - When a defined benefit pension plan could be set up

- Options to review when the goal is to contribute more than $55k per year

- Maximum employee contribution amounts for plans

- Which plans have mandatory matching contribution requirements

- Minimum employer matching contribution amounts

- Plans that have more flexibility

CLICK THE FLOWCHART BELOW TO DOWNLOAD YOUR COPY:

Please let us know if you have any questions about your eligibility or retirement income planning. We are here to help!

This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.