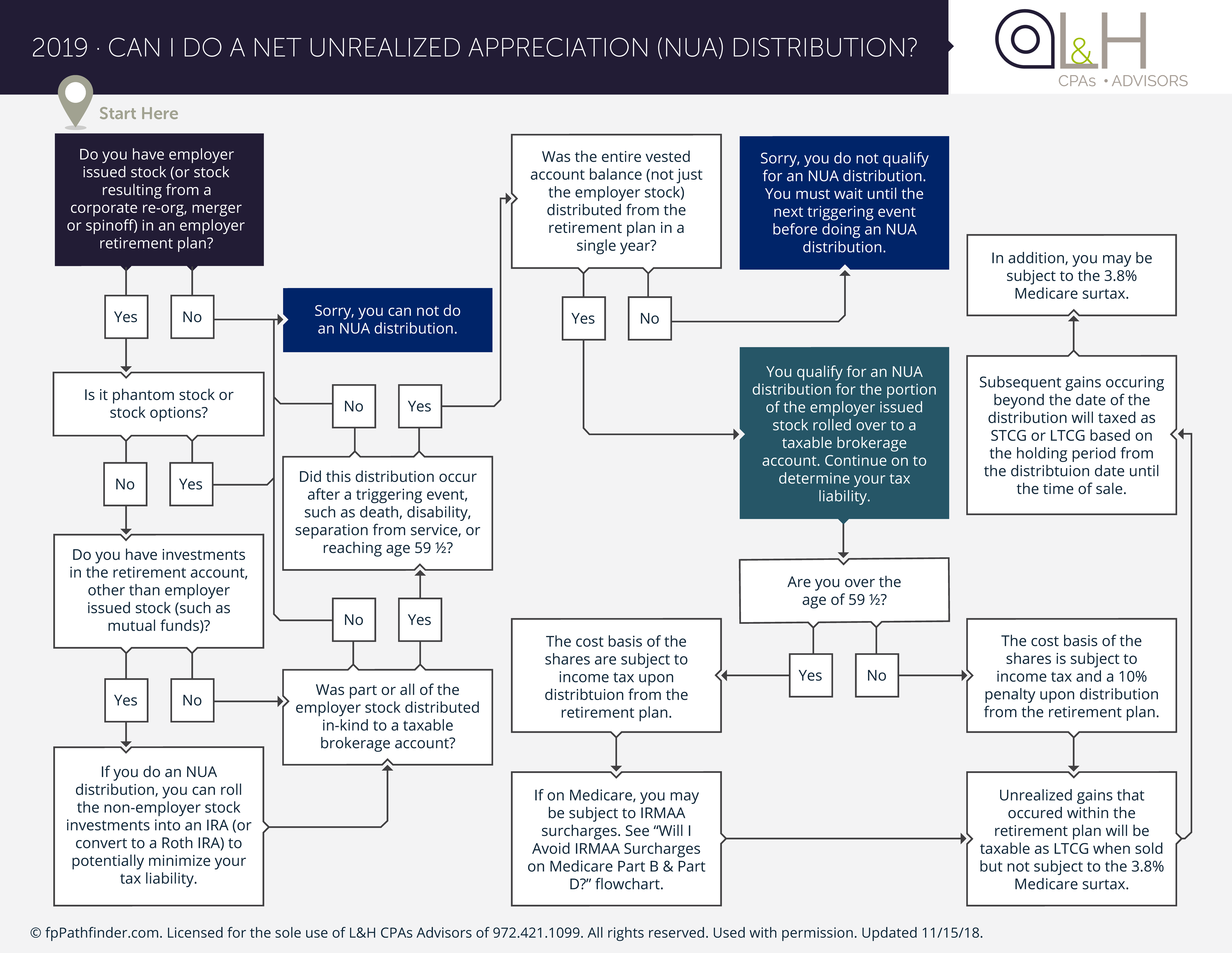

Do you have employer-issued stock in a 401(k) plan? Wondering if a NUA distribution makes sense? There are several very important rules that must be met, some of which are often misunderstood.

To help you make better financial decisions, we have created this flowchart to address some of the most common issues that arise when thinking about doing an NUA distribution:

- What type of stock qualifies

- Triggering events that must be satisfied

- Timing considerations

- Tax impact of the basis and gains

CLICK THE FLOWCHART BELOW TO DOWNLOAD YOUR COPY:

Please let us know if you have any questions about your eligibility or retirement income planning. We are here to help!

This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.