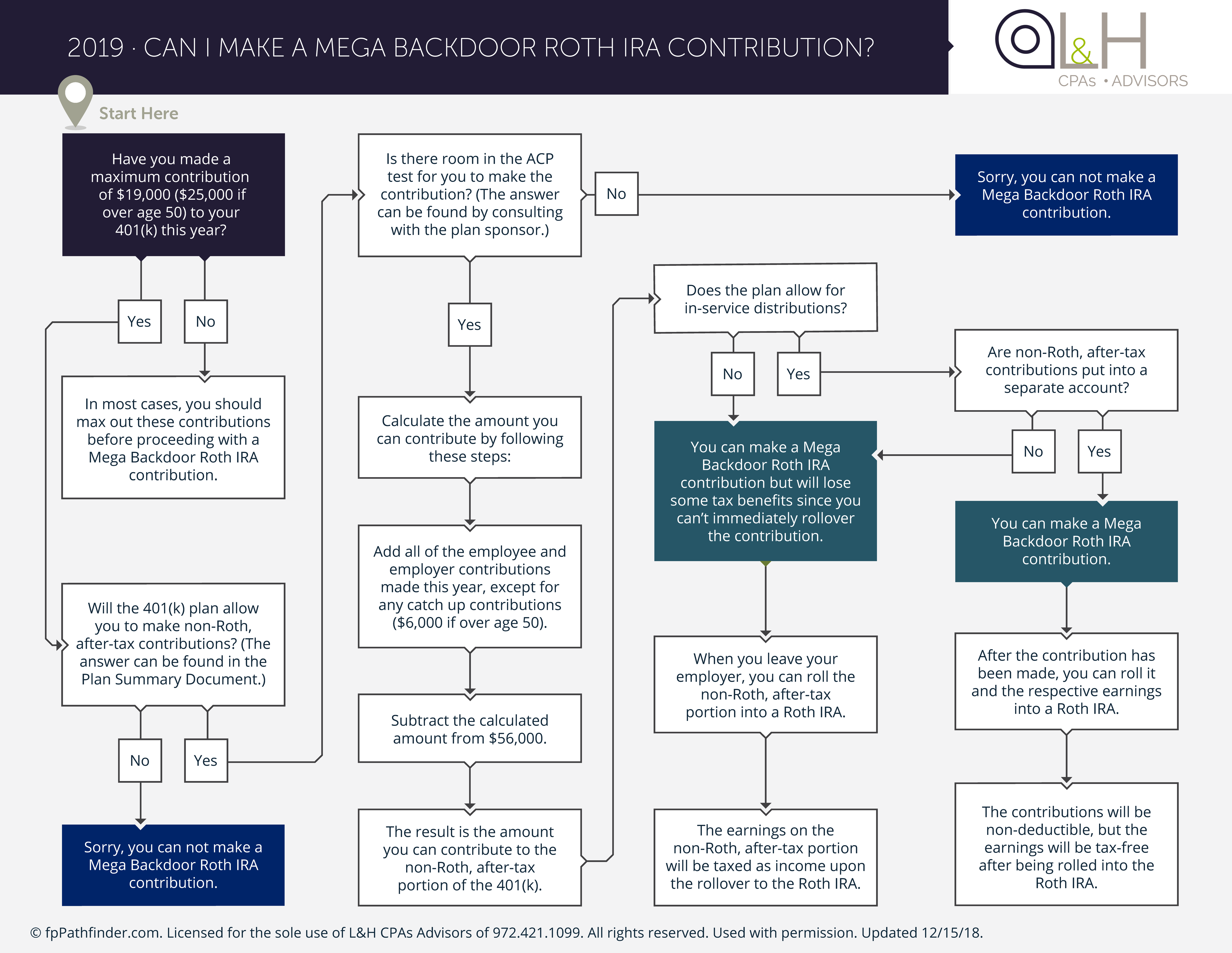

In certain cases, you may be eligible to make a Mega Backdoor Roth IRA contribution. Under the right circumstances, this can allow the client to contribute tens of thousands of dollars into a Roth IRA.

The rules are very restrictive and prohibitive for many, so we created this flowchart to address some of the most common issues that arise when trying to make a Mega Backdoor Roth IRA contribution. This flowchart considers:

- The maximum amount that can be contributed

- The step-by-step process to complete this kind of contribution

- Impact of ACP test

- Impact of the plan allowing in-service distributions

- Impact of the plan having “separate accounts”

- Tax impact upon the rollover

CLICK THE FLOWCHART BELOW TO DOWNLOAD YOUR COPY:

Please let us know if you have any questions about your eligibility or retirement income planning. We are here to help!

This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.