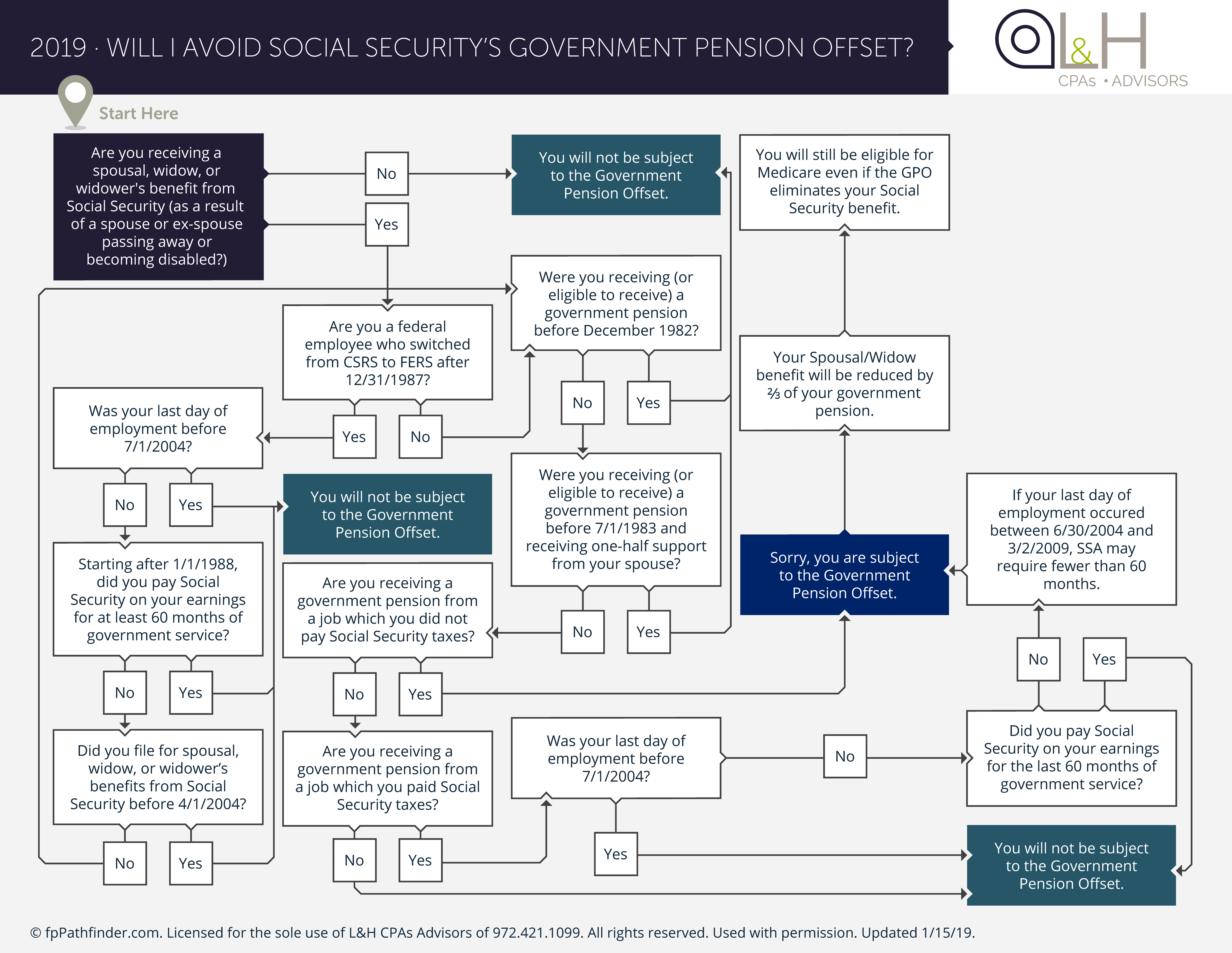

Clients who are receiving a government pension and a Social Security spousal, widow or widower’s benefit based on their spouse or ex-spouse’s work history may be impacted by the Government Pension Offset.

To help make the conversation with clients easier, we have created the “Will I Avoid Social Security’s Government Pension Offset?” flowchart. It addresses some of the most common issues that arise for a client trying to understand the Government Pension Offset. This flowchart considers the following:

- Impact of certain key dates

- Required Social Security contribution period to avoid GPO

- GPO calculation

- Medicare impact

CLICK THE FLOWCHART BELOW TO DOWNLOAD YOUR COPY:

Please let us know if you have any questions about your eligibility or retirement income planning. We are here to help!

This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.