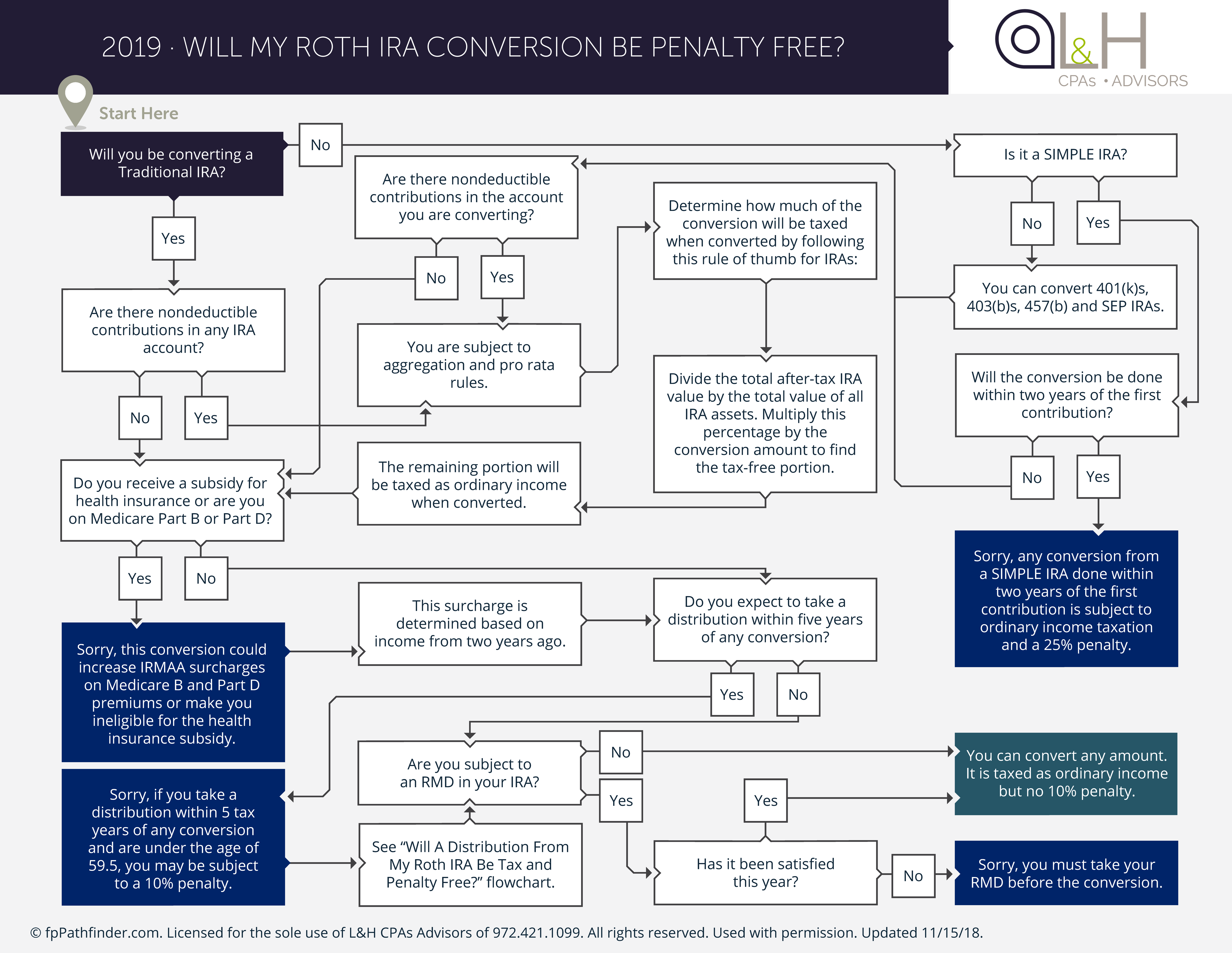

Converting a portion of an IRA to a Roth IRA is complex process that involves many moving parts and can have some unintended consequences if not properly handled, including a possible impact on Medicare premiums two years after the conversion.

To help make this easier, we have created the “Will My Roth IRA Conversion Be Penalty Free? flowchart. It addresses common issues that occur when doing a Roth conversion:

- Implications for IRAs with nondeductible IRA contributions

- Pro-rata and aggregation rules

- Simple IRA rules

- Medicare Part B and Part D surcharge impact

- 5 year rule on the Roth IRA

- 5 year rule on the conversion

- RMD coordination issues

CLICK THE FLOWCHART BELOW TO DOWNLOAD YOUR COPY:

Please let us know if you have any questions about your eligibility or retirement income planning. We are here to help!

This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.