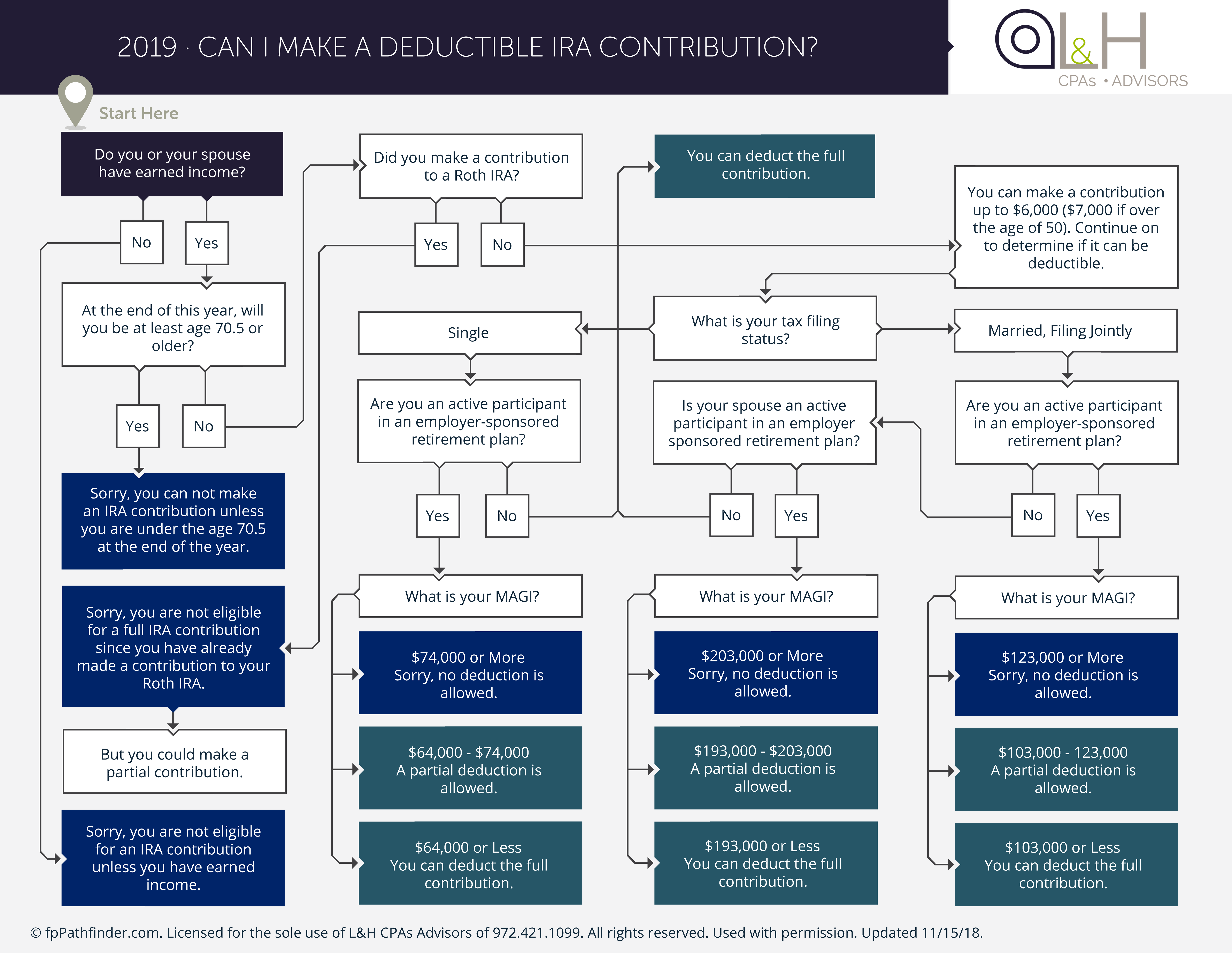

There are many different considerations that affect one’s ability to contribute to a Traditional IRA. To make matters worse, the contribution limits usually change from one year to the next.

To help make this easier, we have created the ”Can I Make A Deductible IRA Contribution” flowchart. It addresses common issues regarding eligibility rules for Traditional and Roth IRAs:

- Earned income phase-out ranges for 2018

- Contributions after age 70.5

- Single vs Married Filing Jointly

- Impact of contributing to a Traditional IRA in the same year

CLICK THE FLOWCHART BELOW TO DOWNLOAD YOUR COPY:

Please let us know if you have any questions about your eligibility or retirement income planning. We are here to help!

This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.